The Last Stand: How the WPP-Publicis War Signals the End of the Agency Era

WPP just launched a brutal public attack on Publicis, accusing their ad tech of trafficking junk inventory. But this isn't about inventory quality—it's the death rattle of an obsolete industry model.

The Market Has Already Decided

While these giants trade blows, the numbers tell the real story:

Agency market share: 45% → 30% (2019-2024)

In-house teams: 66% of brands now have them, up 16% since 2020

Direct publisher relationships: Brands bypassing agency markups for premium inventory exploding across all verticals

The pending Omnicom-IPG merger threatens to dethrone Publicis from its current No. 1 position, while big six holding companies controlled just 29.6% of total US ad spending in Q1 2024—down from 44% in 2019. Even mega-mergers can't stop the bleeding.

Three Forces Killed the Agency Model

AI ate media buying. Nearly 60% of US ad buyers had used or planned to use AI-powered performance advertising products that automate targeting, creative, and optimization completely. Human "expertise" became commodity software overnight.

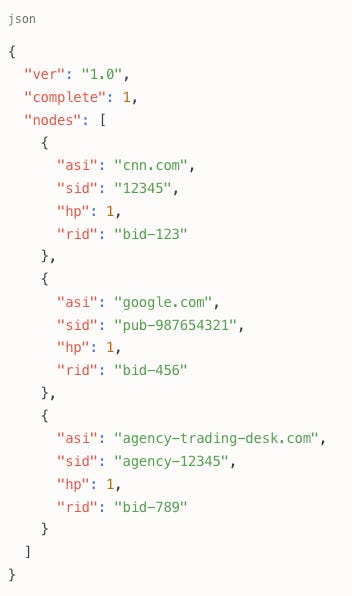

Transparency killed the black box. Tools like ads.txt, sellers.json, and Supply Chain Objects (SCOs) now let brands trace every ad impression back to its exact source and see the full markup chain. SCOs are data structures embedded in every programmatic bid request that show "all intermediaries involved in the sale of a particular impression" mapped "across a chain of nodes that represents all the sellers who were paid." Before SCOs, a brand paid $10 CPM without knowing the breakdown. Now they see the inventory started at CNN.com for $5, with Google Ad Manager taking $2 and their agency trading desk pocketing $3. As one industry expert notes, buyers can now "make data-driven decisions on supply-path optimization" rather than relying on "relationships and intuition." When brands can see exactly who's taking what cut, the agency value proposition evaporates. As AdTechGod's acquisition by Marketecture shows, even industry insiders are building direct content channels, bypassing traditional agency models.

Example: A SCO is embedded in every programmatic bid request as JSON data. Here's a simplified example based on the IAB specification:

First-party data destroyed agency advantage. Customer Data Platforms (CDPs) and clean rooms now let brands activate their own customer data directly—no agency required. Previously, agencies controlled access to audience segments and third-party data partnerships, making brands dependent on their "exclusive relationships." Today, 70% of brands claim to have strategic capabilities in-house, up from 65% in 2020. When Coca-Cola can upload their customer list to Google's clean room, match it with YouTube viewing data, and launch targeted campaigns without paying agency data fees, those "partnerships" become expensive dead weight.

What Winners Are Building

Smart brands aren't choosing agencies—they're choosing independence:

Technology ownership: 83% expect to handle social media buying in-house over the next three years

Direct supply: Premium publishers offering transparent pricing without agency markups

Real accountability: Performance tied directly to business outcomes

In an era when the growing popularity of AI challenges the traditional business model and value proposition of holding companies, IPG and Omnicom are doubling down on scale—but scale alone won't save them.

The 2025 Reality

WPP's methodology—a two-day test buying cheap inventory—perfectly captures why agency "expertise" is worthless today. Static auditing in a real-time world. Sample insights versus continuous monitoring. Competitive theater instead of client value.

The brands winning in 2025 aren't picking sides in yesterday's fight—they're building tomorrow's marketing machine with AI-powered optimization, transparent supply paths, and direct publisher relationships.

Todays agency model is dead. The only question is how long it takes everyone else to realize it.