When a Safety Net Becomes a Profit Net: The 340B Program's $66 Billion Problem

How a drug discount program for low-income patients became a windfall for CVS, Walgreens, and hospital chains — paid for by employers and workers

In August 2024, Johnson & Johnson tried something audacious: instead of giving hospitals upfront discounts on two blockbuster drugs (Stelara and Xarelto) through the 340B program, they’d make hospitals pay full price and wait for rebates later (Healthcare Dive, Aug 2024). The federal government’s response was swift and brutal—threatened termination from Medicaid and fines. J&J backed down within weeks (BioSpace, Oct 2024).

This standoff reveals everything you need to know about 340B: a program Congress created in 1992 to help safety-net hospitals serve low-income and uninsured patients has exploded into a massive program where total purchases exceeded $124 billion at list prices in 2023 (Drug Channels Institute, 2024), with covered entities paying $66.3 billion at discounted 340B prices (Wikipedia, 2024). Even manufacturers can’t pump the brakes.

Senator Bill Cassidy (R-LA), chair of the Senate HELP Committee, spent months in 2024 extracting details from CVS and Walgreens about their 340B profits. His conclusion? “It was never meant to be part of an earnings call. It was meant to be part of patient care.” (Drug Channels Institute, June 2025)

But it’s very much on earnings calls now. CVS disclosed that losing just some 340B business would cut PBM profits by $150-200 million annually (Drug Channels Institute, July 2023). Walgreens warned investors that 340B disruptions cost them $250 million (ibid). These aren’t community pharmacies scraping by—these are Fortune 50 giants extracting massive profits from a safety-net program.

Five Companies Control Three-Quarters of a $66B Market

Drug Channels Institute’s 2025 analysis revealed stunning concentration: CVS Health, Walgreens, Walmart, Cigna (Express Scripts), and UnitedHealth (Optum Rx) control 76.1% of the entire 340B contract pharmacy market (Drug Channels Institute, June 2025). Here’s the scale:

32,069 pharmacy locations (60% of all US pharmacies) operate as 340B contract pharmacies

229,531 contractual relationships between pharmacies and hospitals

Mail/specialty pharmacies from the Big Three PBMs quadrupled from 14,000 (2020) to 57,000 (2025) relationships

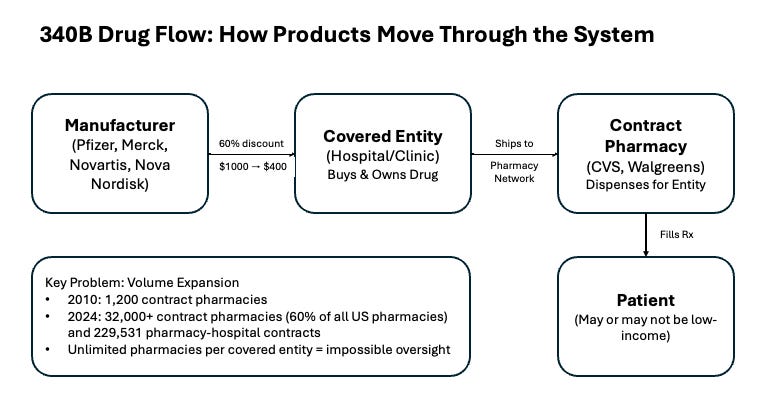

In 2010, there were only 1,000 contract pharmacies nationwide (Drug Channels Institute, 2025). Today? More than 90% of CVS and Walgreens locations participate (ibid).

This isn’t organic growth serving vulnerable communities. It’s systematic expansion to capture a lucrative revenue stream.

Follow the Money: The $599 Spread

Senator Cassidy’s investigation exposed exactly how profitable 340B is for pharmacies. Let’s walk through a real transaction (Senate HELP Committee, 2025):

The Drug Flow:

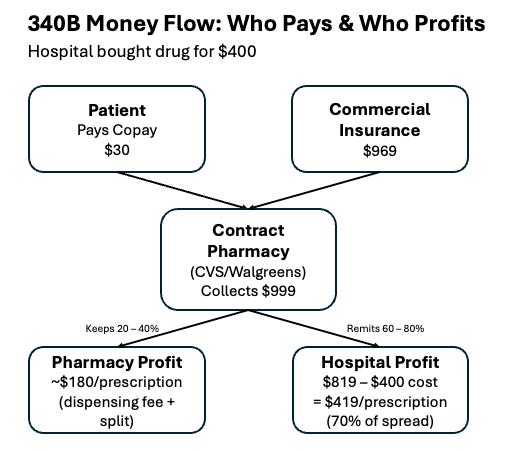

Hospital buys drug for $400 (60% off $1,000 list) (ZS Associates, 2024)

Patient with commercial insurance fills at CVS

CVS collects $969 from insurance + $30 copay = $999

The Split:

According to Cassidy’s report, CVS’s Wellpartner (their 340B administrator) charges hospitals 10-14% of the spread, plus a $4+ per-prescription fee (Senate HELP Committee, May 2025). On a typical prescription:

CVS keeps: ~$180 (dispensing fee + share)

Hospital receives: $819

Hospital’s net profit: $819 - $400 cost = $419

Multiply by millions of prescriptions. For a specialty drug at $5,000 list price, Cassidy found the 340B ceiling price is $2,000 (60% discount). With PBM reimbursement at $4,800, the spread jumps to $2,800—split between pharmacy and hospital (Senate HELP Committee, May 2025).

Who’s paying? Not the government. Not Medicare or Medicaid (which have duplicate discount protections). Employers and their workers, through commercial insurance premiums.

The Cost: Your Employer Is Footing the Bill

An IQVIA study released in January 2025 quantified what 340B costs employer-sponsored health plans state-by-state. Nationally, 340B utilization averages 12% of drug volume, costing employers $43 per covered worker annually (IQVIA, Jan 2025). But that masks wild geographic variation:

Highest-cost states (IQVIA, Jan 2025):

Vermont: 43% utilization, $152 per worker

North Dakota: 37% utilization, $130 per worker

West Virginia: 30% utilization, $105 per worker

Lowest-cost states:

Alabama: 9% utilization, $31 per worker

New Jersey: 4% utilization, $13 per worker

Total annual cost to employers: $6.6 billion (IQVIA, Jan 2025). State and local government employee plans pay another $1.0 billion, with higher per-capita costs due to richer benefits (ibid).

Why the huge variation? IQVIA’s analysis found that rural states with aggressive hospital consolidation and heavy use of “Rural Referral Center” loopholes see 340B penetrate up to 43% of all prescriptions—even though these states aren’t dramatically poorer than the national average (IQVIA, Jan 2025).

The Compliance Disaster: 18% Pass Audits

HRSA, the federal agency overseeing 340B, conducted 144 audits of covered entities in fiscal 2024—and found compliance rates of just 18-38% (Commonwealth Fund, Aug 2025). Between 2012-2019, HRSA identified over 400 duplicate discount violations and 500+ cases of drug diversion to ineligible patients (ZS Associates, 2024).

Enforcement? Virtually none.

A 2024 JAMA Health Forum scoping review examining 289 documents on 340B found “mixed evidence” on whether covered entities use 340B revenue for low-income care. Some studies showed expanded services; others revealed hospitals using funds to acquire physician practices in wealthier neighborhoods and charge facility fees that raised costs for local patients (JAMA Health Forum, Nov 2023).

The triple standoff:

Manufacturers (19 of top 20) restricted contract pharmacies and required claims data to prevent fraud. Result: 340B volume dropped 45% for some drugs (ZS Associates, 2024).

States fought back. Six passed laws prohibiting manufacturer restrictions; 20 more have pending legislation (ZS Associates, May 2024). Each state wrote different rules—some ban claims requirements, others don’t mention them.

HRSA provided no clear guidance, forcing courts to adjudicate conflicts case-by-case.

The Rural Referral Center Loophole: 80% Are Urban

Despite the name, 80% of Rural Referral Centers are in urban areas (ZS Associates, 2024). The threshold? Just 8% low-income patients vs. 12% for regular hospitals (ibid). And there are no geographic limits between parent hospitals and satellite sites.

Cleveland Clinic’s playbook: Register downtown flagship as RRC (serving low-income area). Extend 340B eligibility to 50+ satellite clinics in affluent suburbs. Contract with unlimited pharmacies. Dispense to commercially-insured patients. Keep the spread.

RRCs are the fastest-growing 340B category, with purchases up 400% from 2017-2022 (ZS Associates, 2024). They’re how urban hospital chains access 340B for suburban patients who’d never qualify on their own.

State Bills: Adding $1.9 Billion to the Tab

If all pending state legislation passes prohibiting manufacturer restrictions, IQVIA projects additional costs of:

$1.9 billion for employer-sponsored plans

$273 million for state/local government plans

27% increase in total 340B program costs

The states most impacted? Those that already passed restrictions are seeing costs surge. Eight states with enacted bills (AR, KS, LA, MD, MN, MS, MO, WV) face costs jumping from $223M to $425M—a 91% increase (IQVIA, Jan 2025).

The cruel irony: state taxpayers pay twice—once through their government employee health plans, again through their own employer premiums.

Who Benefits? Not Patients

The JAMA Health Forum scoping review examined 289 documents and found hospitals, clinics, and pharmacies generate revenue while manufacturers forfeit it—but found “mixed evidence“ that revenue goes to low-income patients (JAMA Health Forum, Nov 2023).

What the research shows:

Some covered entities expanded services in underserved areas

Others used 340B funds to acquire physician practices and open sites in higher-income neighborhoods

Studies were “hampered by lack of transparency“ on how $66B+ is used (ibid)

For specialty prescriptions, commercially-insured patients contribute up to one-third of 340B profits through copays and premiums (Senate HELP Committee, May 2025)

A 2018 GAO report confirmed pharmacies profit by trading third-party prescription margins for a share of 340B discounts—often at the expense of low-income, uninsured patients who pay full price (Drug Channels Institute, 2019).

Three Reforms to Save 340B

1. Federal Transparency

Mandate public reporting: How much 340B revenue? How it’s used? Which services funded? Patient demographics? Minnesota and Maine implemented state requirements (Commonwealth Fund, Aug 2025). Make it federal law.

2. Narrow the Patient Definition

The 2023 Genesis Healthcare court case potentially doubled program size by letting covered entities claim patients for up to two years after a single visit, regardless of prescriber or pharmacy (ZS Associates, Sept 2023). Congress must clarify: 340B only applies to drugs prescribed/administered during care episodes at the covered entity.

3. Limit Contract Pharmacies

Default to one pharmacy per entity. Allow additional only where documented access barriers exist (rural areas, underserved communities). Require data sharing to verify eligible patients and prevent duplicate discounts. The unlimited model makes oversight impossible.

The Bottom Line

When Johnson & Johnson tried to add basic accountability to 340B by requiring rebate validation, the system threatened to shut them out of Medicaid entirely (BioSpace, Sept 2024). That tells you everything: 340B has become too big, too profitable, and too politically protected to reform through normal channels.

Since 1992, what started as targeted assistance for vulnerable communities has become:

A $124 billion market at list prices (Drug Channels Institute, 2024) where profits flow to Fortune 50 companies

A major driver of hospital consolidation creating higher costs for local patients

A 50-state compliance nightmare with conflicting regulations

A subsidy paid by employers and workers, not taxpayers

And research shows low-income patients—the intended beneficiaries—often see little to no benefit (JAMA Health Forum, Nov 2023).

Four manufacturers (J&J, Sanofi, Bristol Myers Squibb, Boehringer Ingelheim) have now filed lawsuits challenging HRSA’s authority to block rebate models (Bass Berry & Sims, Dec 2024). All paused implementation after threats of Medicare/Medicaid termination—consequences so severe no manufacturer can risk them.

Senator Cassidy got it right: This program was supposed to be about patient care, not earnings calls. As the Inflation Reduction Act reshapes drug pricing, 340B reform must follow.

When a safety net becomes a profit net, it’s time to cut the ropes.

Sources:

Drug Channels Institute (2025): 340B Contract Pharmacy Market Analysis

IQVIA (Jan 2025): The Cost of the 340B Program to States

Senate HELP Committee (May 2025): Chair Cassidy’s 340B Investigation Report

Commonwealth Fund (Aug 2025): The 340B Drug Pricing Program Explainer

JAMA Health Forum (Nov 2023): Outcomes of the 340B Drug Pricing Program: A Scoping Review

ZS Associates (2024): Exploring the Evolution of 340B Contract Pharmacy Policies

Healthcare Dive, BioSpace, STAT News (Aug-Oct 2024): J&J 340B Rebate Controversy

Wikipedia (2024): 340B Drug Pricing Program Statistics

Bass Berry & Sims (Dec 2024): 340B Rebate Models Litigation Update